TokenEconomist

In the world of cryptocurrency trading, choosing the right entry and exit timing is often more critical than selecting specific coins. Many investors often miss good opportunities because they fail to exit in time. The following insights may inspire your investment decisions:

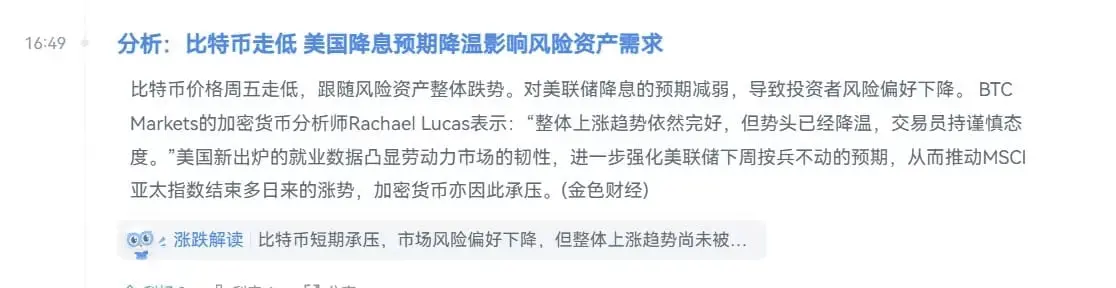

First, when the price of a coin rises followed by a pullback, but the trading volume remains stable, this usually indicates that market enthusiasm is still present and there may be more room for growth. However, if the price hits a new high while the trading volume significantly decreases, this may signal that the market

View OriginalFirst, when the price of a coin rises followed by a pullback, but the trading volume remains stable, this usually indicates that market enthusiasm is still present and there may be more room for growth. However, if the price hits a new high while the trading volume significantly decreases, this may signal that the market