#web3军火库# Share a Go language quantitative resource library, including but not limited to statistical tools, rate limiters, order book implementation, machine learning libraries, trading and backtesting tools, charts, web crawlers, sentiment analysis tools, and other resources.

View OriginalSliipy

No content yet

Sliipy

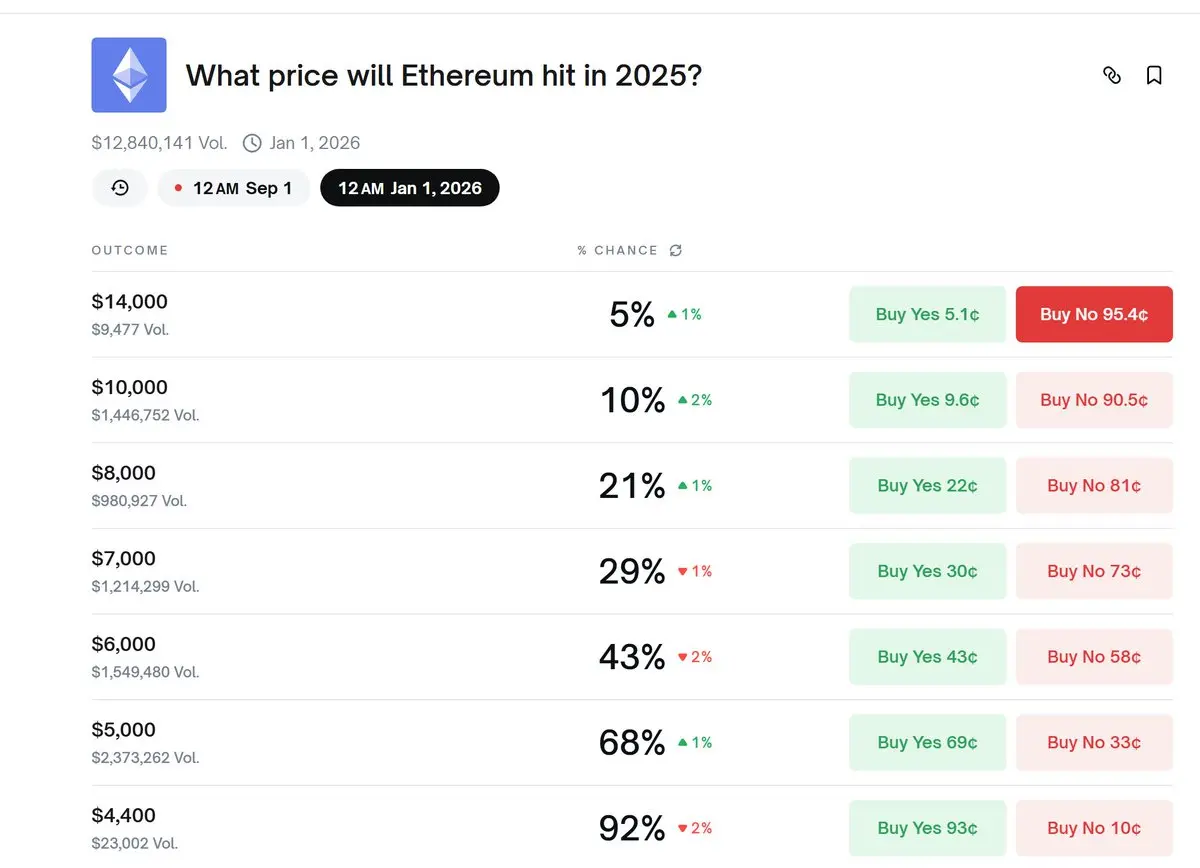

Is the E-Guardian completely crazy? The probability of ETH reaching a price of $14,000 within this year on Polymarket has already reached 5%. Currently, the price of ETH is $4,200, which means it needs to rise 333% in less than 5 months, a net increase of $10,000 to achieve this. Is the market sentiment obviously overheated? A simple "financial" analysis 👇:

0, what does it mean for ETH to rise above 14,000? If the current ETH to BTC exchange rate remains unchanged, after BTC rises by 333%, its market value will exceed 7.8 trillion USD, surpassing the world's largest company, NVIDIA ($4.46 tri

View Original0, what does it mean for ETH to rise above 14,000? If the current ETH to BTC exchange rate remains unchanged, after BTC rises by 333%, its market value will exceed 7.8 trillion USD, surpassing the world's largest company, NVIDIA ($4.46 tri

- Reward

- 1

- Comment

- Repost

- Share

Is the E-Watcher completely crazy? The probability of ETH reaching a price of 14,000 dollars this year on polymarket has already reached 5%. The current price of ETH is 4,200 dollars, and it needs to rise by 333% in less than 4 months, with a net price increase of 10,000 dollars to reach that. Is the market sentiment obviously overheated? A simple "financial" analysis 👇:

0, what does it mean for ETH to rise above 14000? If the current ETH to BTC exchange rate remains unchanged, after a 333% rise, BTC's market cap will exceed 7.8 trillion dollars, surpassing the world's largest company, Nvidia

View Original0, what does it mean for ETH to rise above 14000? If the current ETH to BTC exchange rate remains unchanged, after a 333% rise, BTC's market cap will exceed 7.8 trillion dollars, surpassing the world's largest company, Nvidia

- Reward

- like

- Comment

- Repost

- Share

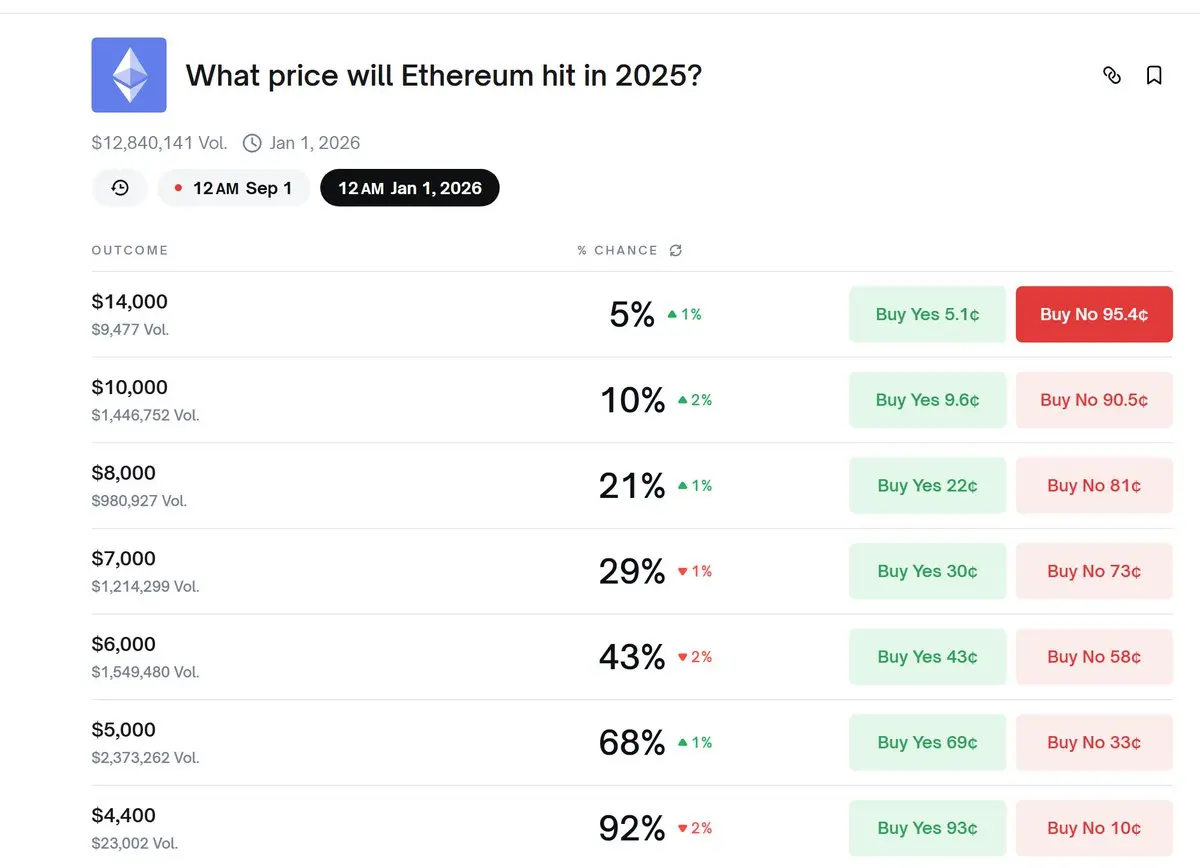

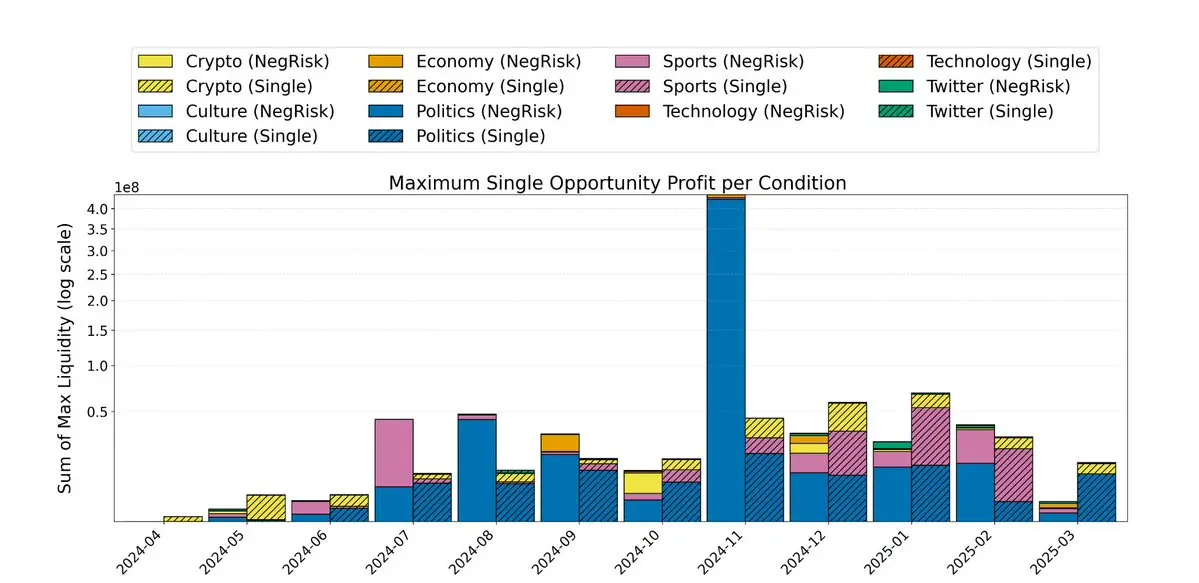

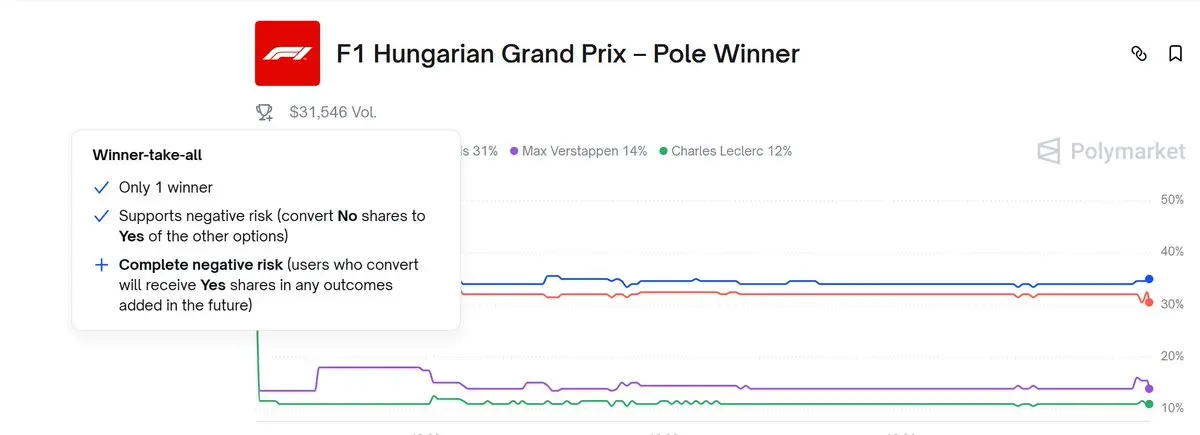

Is Polymarket's combination arbitrage a money printer? Arbitrageurs made nearly $40 million in a year. The authors of the paper released last week revealed the huge profits of combination arbitrage (cross-market arbitrage), while the paper introduced their methods and techniques for automated arbitrage market analysis using LLM, which are worth collecting and studying 👇.

Yesterday, while researching the orderfilled event, I came across this paper "Unravelling the Probabilistic Forest: Arbitrage in Prediction Markets". Later, I found out that my big brother had already shared it a few days ago

Yesterday, while researching the orderfilled event, I came across this paper "Unravelling the Probabilistic Forest: Arbitrage in Prediction Markets". Later, I found out that my big brother had already shared it a few days ago

IN-10.34%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Brothers, I have a question to ask. What is the solution for running a service network proxy on your local machines? I have an idle Mac at home that I want to set up. The proxy I used before with the airport was sometimes unstable and kept disconnecting, and it was quite troublesome to get it running.

View Original- Reward

- like

- Comment

- Repost

- Share

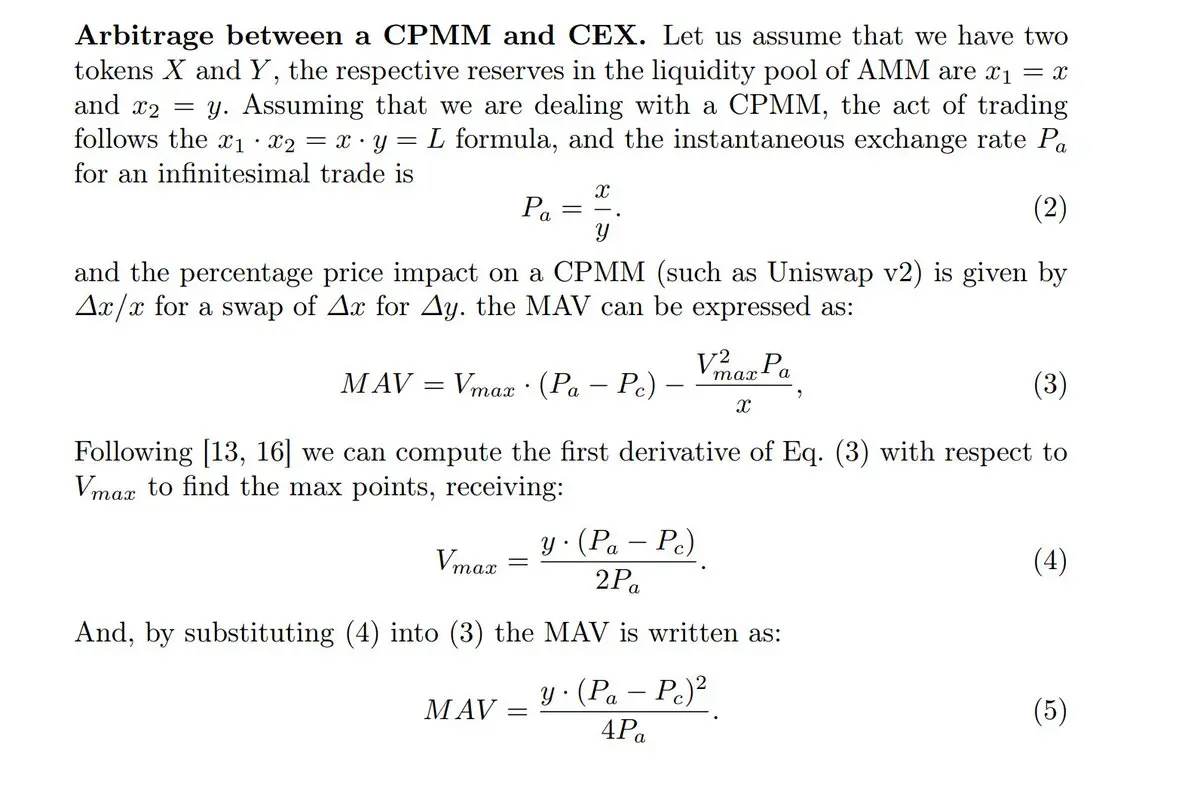

Learn some calculations for cex-dex Arbitrage, starting from scratch to gradually build monitoring infrastructure, on-chain basic knowledge, and mathematical foundations. Arbitrage is the most deterministic thing I've recently come into contact with; it's almost foolproof—if you're willing to invest, you can make money. I hope to start printing money soon.

View Original

- Reward

- like

- Comment

- Repost

- Share

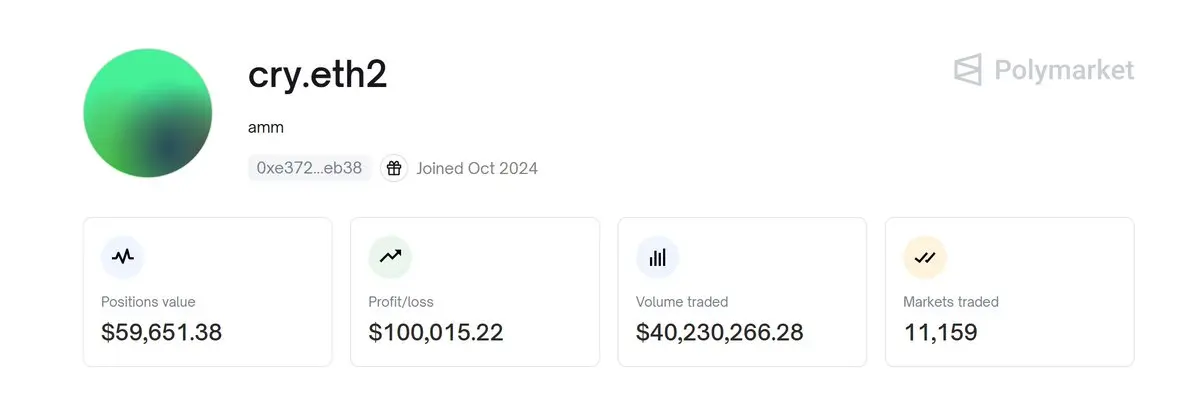

In-depth analysis of a polymarket arbitrage strategy for an address, specifically arbitraging in multi-option markets, turning 10,000 U into 100,000 U in six months, with over 10,000 participants in the market.

Address:

What did this guy do? Simply put, in a market with multiple options where only 1 option will win, if we can spend less than $1 to buy one Yes for each option, then when the results are settled, we will definitely receive $1, and the profit is $1 minus our cost. What he did was continuously earn this profit.

For example, 'Fed decision in July?'}

If the option probability at this

View OriginalAddress:

What did this guy do? Simply put, in a market with multiple options where only 1 option will win, if we can spend less than $1 to buy one Yes for each option, then when the results are settled, we will definitely receive $1, and the profit is $1 minus our cost. What he did was continuously earn this profit.

For example, 'Fed decision in July?'}

If the option probability at this

- Reward

- like

- Comment

- Repost

- Share

EVM indexer implemented in Rust, supporting any EVM compatible chain. Quickly index on-chain events using a YAML file without coding. Those in need of data analysis can take a look 👇

View Original- Reward

- like

- Comment

- Repost

- Share

Is providing liquidity on Polymarket a wealth code? Captured a money-printing account, only a maker in the sports events market, deposited 70,000 USDT in November 2024, withdrew 200,000 USDT two months later, and has since made a profit of 1.6 million USDT up to 2025. Most of it has been withdrawn, and the PnL curve is even at a 45° angle upwards. You can study how to reverse his strategy.

Several conclusions:

1. Even such a fierce guy often stops out of a single event (he has a stop-loss strategy).

2. Based on the brother's capital amount, only 200,000 to 400,000 u is needed to cover the enti

Several conclusions:

1. Even such a fierce guy often stops out of a single event (he has a stop-loss strategy).

2. Based on the brother's capital amount, only 200,000 to 400,000 u is needed to cover the enti

View Original

- Reward

- like

- Comment

- Repost

- Share

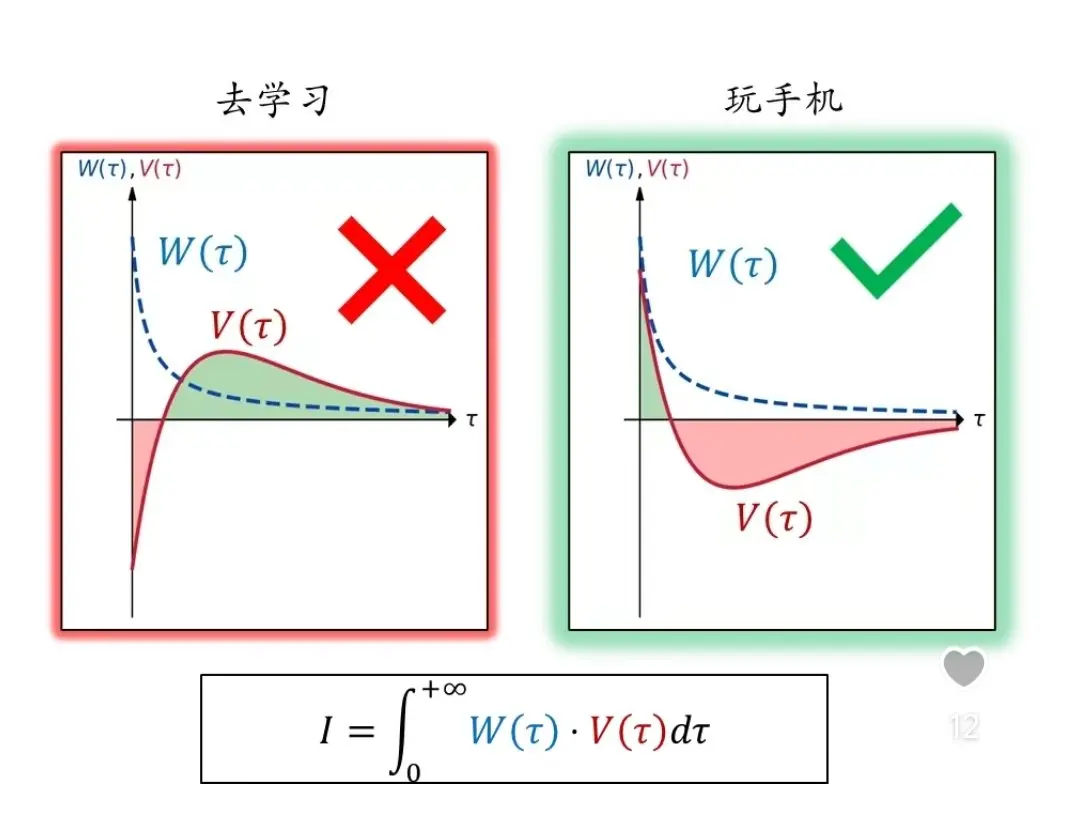

Is this possibly the most hardcore article discussing self-discipline on the Chinese internet? The author uses mathematical modeling and the future value function X discount weight to explain our tendencies when making choices, presenting some interesting viewpoints:

"

In this article, the core idea I want to convey is that the issue of self-control may not only be a psychological or physiological problem, but perhaps it can also be an engineering problem that can be solved using mathematics and physics. Based on the above concept, there exists the possibility that a person can exert lasting a

View Original"

In this article, the core idea I want to convey is that the issue of self-control may not only be a psychological or physiological problem, but perhaps it can also be an engineering problem that can be solved using mathematics and physics. Based on the above concept, there exists the possibility that a person can exert lasting a

- Reward

- like

- Comment

- Repost

- Share

Sharing an article discussing aggregators and MEV, which does not involve technical implementation but instead discusses the MEV protection of mainstream aggregators on ETH and SOL. Interestingly, it analyzes user profiles of different products through data analysis and summarizes the statistical relationship between the aggregator's market capitalization and monthly volume (0.2-0.3u FDV / 1u monthly volume ), which can provide a reference for evaluating the FDV of aggregator products (note the timeliness).

Article link:

View OriginalArticle link:

- Reward

- like

- Comment

- Repost

- Share

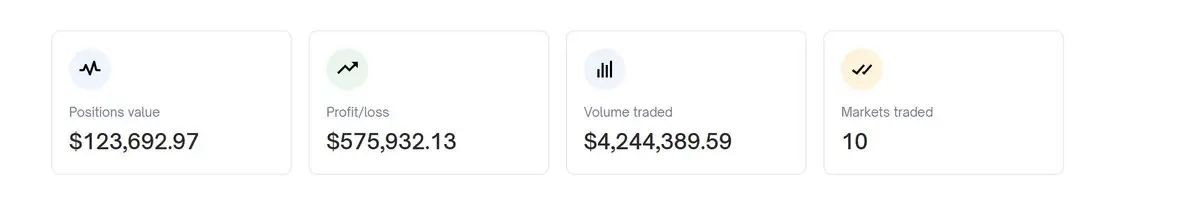

Listening to a wallet on polymarket that made $570,000 last year waking up after a year. In the past, this wallet focused on political events, with a record of 7 wins and 7 matches, achieving a win rate of 100%. In the last 3 days, it has accumulated $100,000 on a certain domestic political event's Yes, with an expected profit of $1,000,000.

View Original

- Reward

- like

- Comment

- Repost

- Share

Share a bit about Stanford University's Defi introductory course, the homework exercises involve mathematical proofs related to MEV( clippers )... very hardcore, you can choose to study what interests you.

Course link:

Course Directory:

1. Overview of Blockchain Basics and Its Interaction Methods

3. Basic Properties of Constant Function Market Makers

4, the results of the "complex" constant function market maker.

5. Oracles and miners can extract value and atomicity.

6. Lending and Stablecoins

7. Staking and Staking Derivatives

8. Optimal Routing and Order Execution

Exercise Book:

Course link:

Course Directory:

1. Overview of Blockchain Basics and Its Interaction Methods

3. Basic Properties of Constant Function Market Makers

4, the results of the "complex" constant function market maker.

5. Oracles and miners can extract value and atomicity.

6. Lending and Stablecoins

7. Staking and Staking Derivatives

8. Optimal Routing and Order Execution

Exercise Book:

DEFI-0.75%

- Reward

- like

- Comment

- Repost

- Share

Share a bit about Stanford University's introduction to DeFi course. The homework includes mathematical proofs related to MEV( clamps )... very hardcore, you can choose to learn what interests you.

Course link:

Course Directory:

1. Overview of Blockchain Basics and Its Interaction Methods

3. Basic Properties of Constant Function Market Makers

4. The results of the "complex" constant function market maker.

5. Oracles and miners can extract value and atomicity.

6. Lending and Stablecoins

7. Staking and Staking Derivatives

8. Optimal Routing and Order Execution

Course link:

Course Directory:

1. Overview of Blockchain Basics and Its Interaction Methods

3. Basic Properties of Constant Function Market Makers

4. The results of the "complex" constant function market maker.

5. Oracles and miners can extract value and atomicity.

6. Lending and Stablecoins

7. Staking and Staking Derivatives

8. Optimal Routing and Order Execution

DEFI-0.75%

- Reward

- 1

- 1

- Repost

- Share

BIRJA :

:

Thanks for the your sharingDiscussion about probabilists:

" What kind of person is a probabilist, Just Invert, what kind of person is not a probabilist:

When passing by a lottery booth, I can't help but think about those who buy lottery tickets: how can they be so certain that they will be the lucky ones, knowing that "a large portion of the money spent on lottery tickets contributes to the lottery operating units from a probabilistic standpoint."

Those who trade stocks or stock mutual funds in the short term: Overall, the stock market in the short term is a zero-sum game where one's gain is another's loss. After deduct

View Original" What kind of person is a probabilist, Just Invert, what kind of person is not a probabilist:

When passing by a lottery booth, I can't help but think about those who buy lottery tickets: how can they be so certain that they will be the lucky ones, knowing that "a large portion of the money spent on lottery tickets contributes to the lottery operating units from a probabilistic standpoint."

Those who trade stocks or stock mutual funds in the short term: Overall, the stock market in the short term is a zero-sum game where one's gain is another's loss. After deduct

- Reward

- like

- Comment

- Repost

- Share

#Inspiration The best arbitrage may not necessarily extract all liquidity value. A large arbitrage trade itself may create new arbitrage opportunities. Alternatively, it may take two or more trades to fully capture the arbitrage opportunities generated by the target exchange.

View Original- Reward

- like

- Comment

- Repost

- Share

#Financial Products If you are currently holding a pocketful of BTC and also have some U in hand while watching the market, you might as well try buying No on polymarket for Ethereum's price hit 8000 in 2025. The Yes bet has risen by 50% in price over the past two weeks, so taking advantage of the high sentiment of E guardians, you can consider placing open orders to buy No.

The current price of Ethereum is around 3200. If it needs to reach 8000 by 2025, it requires a rise of 4800, which means it needs to increase by approximately 870 per month for five consecutive months, equivalent to a mont

View OriginalThe current price of Ethereum is around 3200. If it needs to reach 8000 by 2025, it requires a rise of 4800, which means it needs to increase by approximately 870 per month for five consecutive months, equivalent to a mont

- Reward

- like

- Comment

- Repost

- Share